SpaceX IPO Explained: Is SpaceX Going Public and Can You Buy SpaceX Stock Now?

Uncover the details of SpaceX’s IPO plans. Get informed about the possibility of buying SpaceX stock and what it could mean for your portfolio.

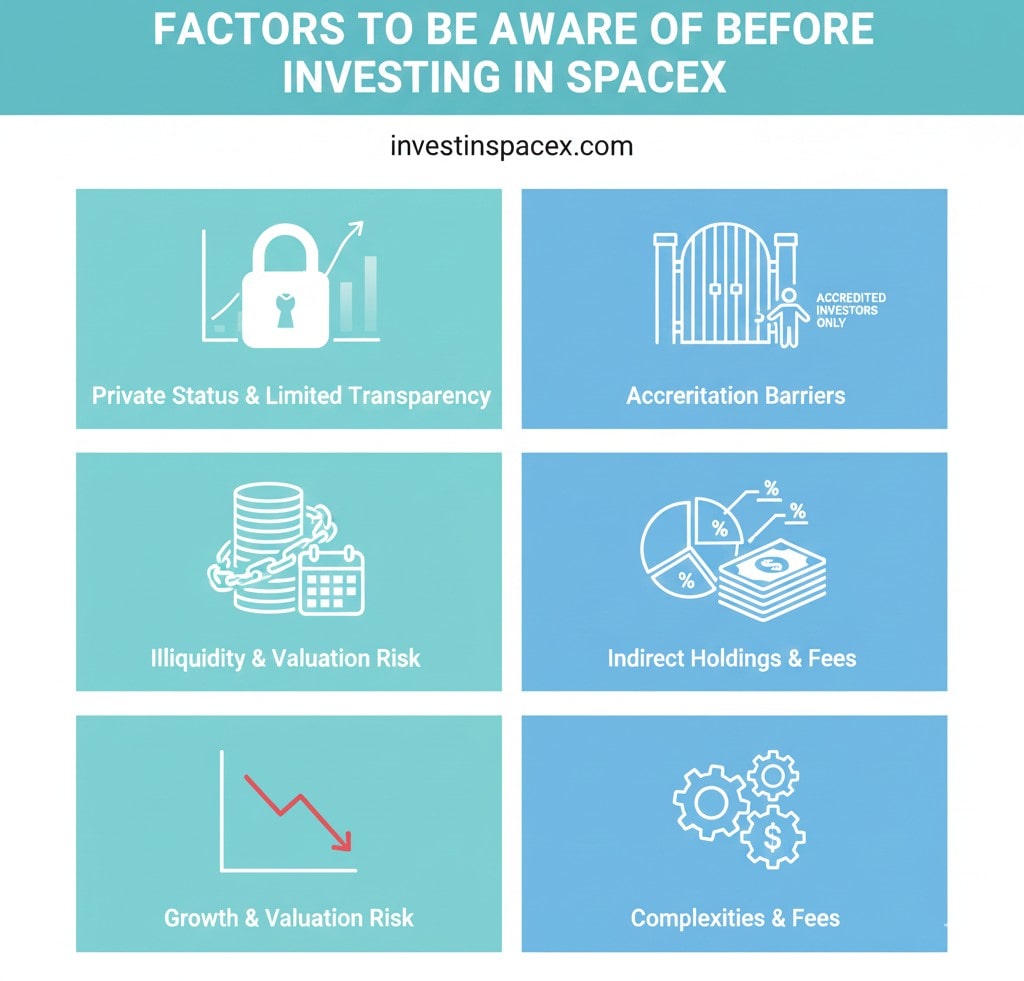

✔ SpaceX offers long-term growth potential driven by satellite internet expansion, space innovation, and institutional demand, but access remains limited due to its private status.

✔ Most investors can only gain exposure indirectly, while direct participation is typically restricted to private markets with higher complexity.

✔ Private investments in SpaceX involve risks such as illiquidity, limited transparency, and elevated valuations.

✔ Investing in SpaceX may suit long-term, risk-tolerant strategies rather than short-term or conservative portfolios.

✔ A future public listing is possible but uncertain, making patience and informed decision-making essential.

SpaceX has reshaped space travel and satellite internet, and that success has sparked a simple investor question: can someone buy SpaceX stock before it goes public? The challenge is that SpaceX is private, so access looks very different depending on whether an investor is accredited or retail.

Investing in SpaceX is driven by several powerful growth narratives that extend far beyond rocket launches.

While SpaceX stocks are not publicly traded, understanding where the company’s value creation may come from helps investors assess whether and how to invest in SpaceX, either directly through private markets or indirectly through funds. Below are the core opportunity areas, structured for clarity and comparison.

Starlink is widely considered the most commercially transformative part of SpaceX’s business and a major reason investors are researching how to invest in SpaceX.

Why Starlink matters to investors:

From an investment perspective, Starlink shifts SpaceX away from purely mission-based revenue toward a scalable consumer and enterprise service.

SpaceX’s ambition to support human life on Mars is often viewed as distant, but from an investor standpoint, the opportunity lies in what this goal accelerates today.

Key investment implications:

Rather than a single end goal, Mars colonization functions as a technology catalyst. These advances can translate into commercial advantages long before any Mars settlement becomes realistic.

For those evaluating how to invest in SpaceX, this innovation flywheel is part of why SpaceX stocks command such strong demand in private markets despite long timelines.

Unlike many high-growth tech companies, SpaceX benefits from significant government relationships that provide both revenue stability and credibility.

Notable strengths in this area include:

Government contracts tend to be multi-year and mission-critical, which can smooth revenue volatility and support long-term planning. For investors looking to invest in SpaceX, these contracts help offset the risks tied to experimental projects and reinforce the company’s position as a core player in the global space economy.

SpaceX does not publish the same level of financial detail as public companies. That means investors often rely on third-party reporting and estimates.

Direct access through private marketplaces typically requires accredited investor status, which limits participation for many households.

Private shares can be hard to sell. Lock-up periods and limited buyer pools mean capital may be tied up for years. This is one of the biggest hidden costs when people try to invest in SpaceX early.

Private valuations can be aggressive. If growth assumptions around Starlink or launch services slow, future returns may disappoint even if the company remains successful.

Funds that include SpaceX may also hold major positions in other companies that drive results more than SpaceX exposure. This can reduce correlation to SpaceX’s performance and create unintended concentration risk.

Private marketplaces, venture funds, and specialized products can charge meaningful fees. Even a small percentage annual can compound into a large drag on long-term returns.

Because SpaceX is private, buying shares is not as simple as placing a trade through a brokerage account. Anyone researching how to buy SpaceX stock should expect limited availability, stricter eligibility rules, and more complex deal terms.

The most direct route is a private transaction where existing shareholders sell to qualified buyers. Deals are often handled through specialized marketplaces or networks and can involve higher minimums and longer hold times.

Some investors choose indirect exposure through certain funds or public companies with ties to SpaceX. This approach offers partial participation in the story, even though it is not direct ownership for those exploring how to buy SpaceX stock.

If SpaceX or a related business goes public, access becomes far simpler. Until then, staying informed and patient is often the most realistic approach.

For investors who want early exposure to a category-defining company, SpaceX is understandably tempting. It leads in launch services, has long-running government relationships, and Starlink adds a potentially massive recurring-revenue business. These strengths are why many people want to invest in SpaceX before any IPO.

Still, there are serious tradeoffs. SpaceX is private, meaning limited financial transparency and fewer investor protections than a public stock. Valuations can be high, liquidity can be extremely limited, and timelines can stretch for years. In short, investing in SpaceX can fit a high-risk, long-term portfolio, but it is not a one-size-fits-all move.

SpaceX leadership and its advisory team are reportedly targeting a public listing as early as mid to late 2026. However, the exact timing remains flexible and could shift depending on broader market conditions and internal considerations. According to the report, there is also a possibility that the IPO timeline could be pushed back to 2027 if circumstances change.

The most reliable signals of a future listing are official company statements and regulatory filings, not rumors. Anyone trying to invest in SpaceX should treat IPO speculation as just that: speculation

Yes, some investors use indirect routes like certain funds or public companies connected to SpaceX. This does not provide direct ownership. Exposure levels can be small and vary by product.

Private companies share less public information and have fewer reporting requirements. Buying and selling is usually harder and slower. That adds uncertainty compared to public stocks.

Private investments are often long-term with no set exit date. Investors may wait years for a liquidity event. Capital can be tied up longer than expected.

Not always. Returns depend on the price paid, fees, and the eventual exit. A great company can still be a poor investment at the wrong valuation.

Yes, market conditions can influence valuations and liquidity options. Timing can impact what investors pay and what they can sell for. Company performance is only part of the equation

Anyone looking to invest in SpaceX should first understand how private-market exposure works, explore the most common ways to gain access, and stay positioned to act when viable opportunities appear.

Invest in SpaceX By Best connects investors and strategic partners with experienced professionals who can help weigh available options, outline key risks, and provide guidance throughout the decision-making process. With informed support, it becomes easier to focus on credible paths and make choices with clarity.

Connect with an advisor through Invest in SpaceX By Best today!

DISCLAIMER:

This content is for informational and educational purposes only and should not be considered financial, investment, or legal advice. References to SpaceX, investment strategies, or potential opportunities are general in nature and do not constitute an offer, solicitation, or recommendation to buy or sell any securities. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Uncover the details of SpaceX’s IPO plans. Get informed about the possibility of buying SpaceX stock and what it could mean for your portfolio.

SpaceX is no longer just a visionary startup launching rockets. It is a dominant force in aerospace, satellite communications, and national defense. As its influence grows, interest from investors continues to surge.

SpaceX has reshaped space travel and satellite internet, and that success has sparked a simple investor question: can someone buy SpaceX stock before it goes public? The challenge is that SpaceX is private, so access looks very different depending on whether an investor is accredited or retail.

SpaceX is one of the most watched private companies on the planet, and plenty of people still wonder if there’s a way to get exposure before any future public listing. The interest isn’t random: SpaceX combines frontier tech, steady government demand, and a long-range vision that keeps it in the spotlight. Still, trying to invest in SpaceX isn’t as simple as buying a public stock through a brokerage app.

If you’ve been trying to figure out how to invest in SpaceX, you’re not alone—millions of Americans want a piece of one of the most innovative companies ever built. But because SpaceX is still private, the path isn’t straightforward.